Get the free income tax

Get, Create, Make and Sign income documents form

Editing tax section act online

How to fill out income tax act form

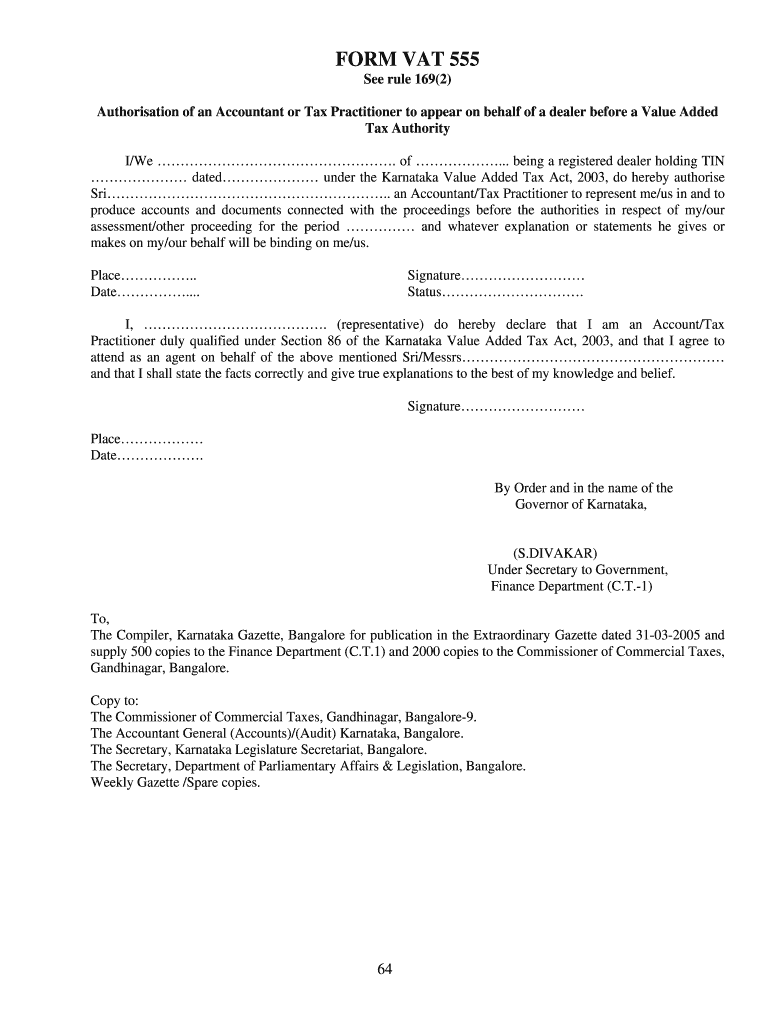

How to fill out India VAT 555

Who needs India VAT 555?

Video instructions and help with filling out and completing income tax

Instructions and Help about income tax section

In this video were going to show you how to add v80 to a figure and also how to take away it to an already via t included price so lets get started well do a really simple example we say we've got to 100 pounds with a product, and we need to add a 20 it rates to this, so we simply add 100 into the calculator then press the multiplication button and then press the 1 point and then the rate of v80 so if the rate of it is 20 we will enter 20 if the rate of NOT is 175 would enter 175 if the rate of it is 5 we would enter 0 5 so for this argument were going to say is 20 percent as that's the core rate, so we enter the 20 and then press the equal sign and as you can see we've added a rate of 20 percent it to the price a more complicated example which isn't 100 which is really easy is say 189 pounds, and we need to add V 80 at a rate of 175 to this again press the multiplication button and then press the 117 5 and press the equal sign now what if we just want to show the rate of v80 at the end and not the price plus the deity that's easy as well so if we until 189 than we press the multiplication button but this time so the one we press the zero which means were not including the original price, so we press the zero and then well press the point and then 17 5 equals to this, so again we do it for 20 percent we would enter 1 8 9 times zero point twenty percent and then pose equal sign if you're interested in removing v80 from a price that's already got NOT included that's really easy say we have a price of 400 pounds, and we want to remove a rate of 20 percent it from this it's another multiplication button we press the divide button, and then we press one point 20 without putting the 20 without putting the in and then push the equals as you can see we are left with the price which has got V 80 removed another example could be 989 pounds — a rate of seventeen point five percent, so again we press the divide and then press 117 five and then press the equal sign and that's the price there I hope this video has been really useful to you, it's a quick and easy way to add and subtract V 80 from prices I've also developed an online calculator which you can find on the web at easy v 80 calculator call UK its advert free and completely free, or you've got to do is enter your amounts add VA t to it or subtract it thanks for watching

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax person for eSignature?

How do I complete tax documents person online?

How can I fill out income provisions on an iOS device?

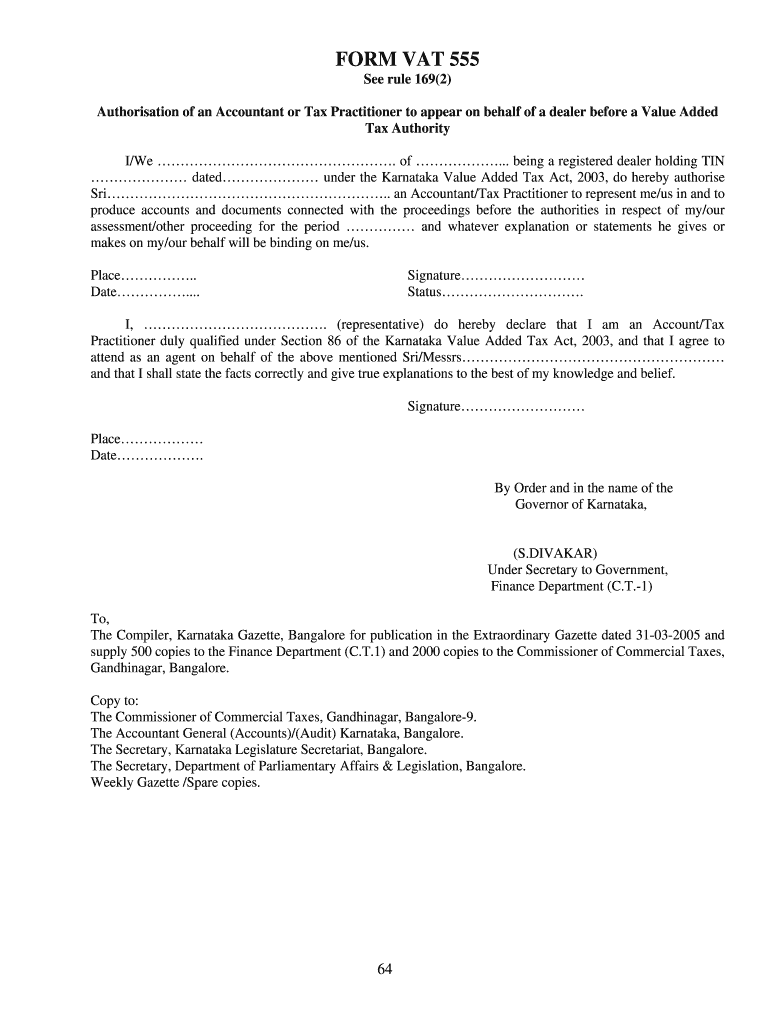

What is India VAT 555?

Who is required to file India VAT 555?

How to fill out India VAT 555?

What is the purpose of India VAT 555?

What information must be reported on India VAT 555?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.